This paper argues that fiscal policy should not be governed but guided by rules. Rules alone lack legitimacy, accountability, and flexibility, but in a hybrid fiscal architecture they can be alleviated of their detriments while contributing to better fiscal policies.

The past 20 years have shown a resurrection of fiscal policy as a viable policy instrument, as well as a need for new means of coordinating it in the highly interdependent Eurozone. This paper argues that Eurozone fiscal architecture (as well as fiscal policy in general) should not be governed by rules alone, as they lack legitimacy, accountability, and flexibility, and bear the risk of under-enforcement due to over-complication. Nevertheless, rules are not useless – they have proven to be effective means of coordination to overcome discretionary fallacies, such as overly optimistic budget planning, opportunistic pre-election spending, or surplus biases. Therefore, this paper proposes a hybrid architecture where discretionary choice is guided (not governed) by rules and overlooked by independent fiscal councils on national and Eurozone level.

Rules lack legitimacy: As fiscal policy deals with decisions on how to spend publicly, which taxes to levy, and whom to provide with redistributive benefits, fiscal decisions are highly normative. Unlike monetary policies, fiscal policies are not “technical” choices of means under an undisputed end but a decision on ends. To choose among ends, democracy requires legitimacy, which rules can provide only to a very limited extend. Rules are not per se legitimate as their level of legitimacy depends on the imposer and the executor, and decreases drastically over time. A worst-case example for non-legitimate fiscal rules: Outdated rules that were imposed by non-legitimized actors, such as the European Commission, and are executed without any democratic feedback loop.

Rules lack accountability: Policy success is measured in how far the policy is able achieve its goal. In a functioning democracy, if a policy fails, associated decisionmakers are held accountable and must fear electoral consequences for their misconduct. This feedback mechanism is particularly important for normative questions, such as redistribution, where the supremacy of one level of redistribution can only be democratically assessed. As democratic feedback loops work poorly on rules themselves, fiscal rules lack accountability. This is especially true if the imposing entity is not affected by feedback loops either.

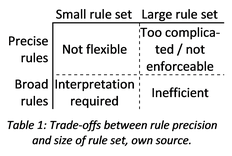

Rules lack flexibility or enforcement: For rules to govern, they need to adjust to changing circumstances. This is especially important in fiscal policy, which is often expected to quickly react to balance economic cycles or shift actual to potential output. This results in a dilemma: Rule sets can either be large to anticipate more changes in environment but then run the risk of complexity beyond a level of understandability and enforceability [1]. This happened with the current fiscal rule set in the Eurozone. Or, rules adapt to changing environment by only referring to broad definition instead of explicit prescription but then do not govern encompassingly as further non-rule-inherent interpretation and adaption is needed. Table 1 illustrates the unfavourable trade-offs between flexibility, enforceability, and need for interpretation.

Despite a rule set’s inability to govern alone, they are still applicable to overcome detriments of fiscal policy entirely based on discretionary choice (e.g., reduce surplus biases, counterbalance “fiscal illusion” [2], suppress opportunistic pre-election spending, reduce externalities on neighbours, improve interest rate channel of monetary policy by lowering money market uncertainty, etc.). Combining potentials and alleviating pitfalls, a hybrid fiscal architecture for the Euro area is put forward by important scholars and organizations (French Council of Economic Analysis, German Economic Council, 15 pan-European CEPR scholar, etc.). This paper argues in line with their overall direction, emphasizing the inability of rules to govern alone while promoting fiscal policy to become a discretionary choice under rule-based principles, enforced and controlled by independent fiscal councils on national and European level.

[1] Comparable conceptual difficulties can be observed at the economic theory of “incomplete contracts”: It states that it is inefficient for rational actors to create perfect contracts, and impossible for anyone to foresee future events and their necessary reaction in contracts or rules. See, for example, Grossman/Hart (1986): "The costs and benefits of ownership”, Journal of Political Economy.

[2] The “fiscal illusion” is based on the population’s imperfect understanding of tax and debt finance combined with a misperception of the government’s intertemporal budget constraint. See Eyraud et al. 2017: Fiscal Politics in the Euro Area, IMF Working Paper, for example

This OnePager is part of a six piece series written for the course "Advanced Economics: Economic Theory & Policy" at Hertie School of Governance, lectured by Prof Jean Pisani-Ferry, Chief Economist of the French President and Professor at Hertie School of Governance and SciencePo.

Write a comment